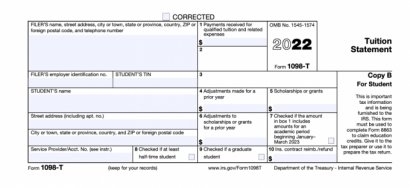

IRS regulations require ODU to provide a statement of tuition and charges billed each calendar year. This statement is called a 1098T.

No later than January 31 of each calendar year, all eligible students will be issued a form for the prior calendar year. Students may review payment information on Leo Online. Students and parents are advised to use personal financial records to determine the qualifying amount for tax purposes since the definition of "qualified tuition" may include other related expenses.

Effective January, 2024 - 1098T statements may be delivered electronically once available. Electronic delivery of these forms has many benefits including: earlier access, decreased loss or delayed hardcopy delivery, the process is simple and secure, and students may access their forms from any internet connected device at any time. To consent to electronic delivery, please visit this link and submt the electronic delivery consent.

Qualified Tuition & Related Expenses

According to the IRS, the term "qualified tuition and related expenses" means the tuition and fees an individual is required to pay in order to be enrolled at or attend an eligible institution.

NOT QUALIFIED:

The following are not defined as qualified tuition or related expenses:

- Charges and fees associated with room and board

- Student activities

- Athletics

- Insurance

- Books

- Equipment

- Transportation and similar personal, living, or family expenses

- Expenses paid with a Pell Grant or other tax-free scholarship, a tax-free distribution from an Education IRA, or tax-free employer-provided educational assistance are not taken into account in calculating the credit amount.

About the 1098-T Form

-

Students who pre-registered in the prior calendar year for courses in the next calendar year will not have the cost included in the figure reported. (1) The law says that schools must send this information to each taxpayer and to the IRS. For the referenced tax year, this information will include:

-

the name, address, and taxpayer ID number of the school

-

the name, address, and taxpayer ID of the student for whom tuition was paid

-

whether the student was enrolled at least half-time

-

whether the student was enrolled only in a graduate-level program

-

costs for referenced year courses (1)

-

-

The IRS does not require taxpayers to submit 1098T forms when filing tax returns.

-

The education tax credit amount the taxpayer can claim should be based on the taxpayer's personal records.

-

Professional tax advisors should be consulted. The University cannot determine if a student qualifies for the tax credit or supply tax advice.

-

Forms will be sent to the student's permanent address on file with the University.

Frequently Asked Questions (FAQ)

The 1098-T is a statement of related tuition expenses in the referenced calendar year. The form contains elements that the IRS will find helpful in calculating a student's eligibility for the Hope Scholarship Credit and Lifetime Learning Credit. All students enrolled for credit courses with reportable transactions will receive a 1098T Statement.

- Students who pre-registered for Spring courses in the prior calendar year will not have the charges reported until the applicable calendar year. The due date for those charges is not until the next calendar year.

- Students may use their own records to report any payments made towards Spring in the prior calendar year.

ODU does not report payments made towards tuition on the 1098T. ODU supplies students with their qualified tuition charges to use as a tool to calculate their own payments. Students will have to use their own records to determine actual amounts paid.

ODU is complying with the requirements of the IRS. We are approved to report qualified tuition charges. The IRS established new requirements beginning with the 2004 reporting year.

All scholarship and grant payments made to your account except Federal Direct Student Loans - both unsubsidized and subsidized. Parent Plus loans.

A 1098T is provided to assist you in figuring your tax credit. It is only one piece of several educational expenses you should consider. Form 8863 (Education Credits) does not ask you to report this amount. You report expenses based on your own financial records. Please consult a tax advisor if you have additional questions.

No. While we want to be helpful to students and their families, ODU staff is not qualified to assist you. The regulations are complex and we do not want to inadvertently misinform.

- IRS Publication 970

- Contact your tax advisor.

- www.irs.gov

Refer to your personal financial records or view your ODU student account on Leo Online for detailed information. We only provide the 1098T.

Effective January, 2024 - 1098T statements may be delivered electronically once available. Electronic delivery of these forms has many benefits including: earlier access, decreased loss or delayed hardcopy delivery, the process is simple and secure, and students may access their forms from any internet connected device at any time. To consent to electronic delivery, please visit this link and submt the electronic delivery consent.

Students may also request a hardcopy duplicate form be mailed to their permanent address on file after February 10 of each year. Students may request a duplicate 1098T statement or visit LeoOnline and print a copy. Please allow two weeks for processing a duplicate statement.

Please be sure that your permanent address on file with Old Dominion University is correct prior to submitting your request for a duplicate. Requests for duplicates are limited to one and must be submitted in writing to:

Customer Relations

Old Dominion University

Rollins Hall

Norfolk, VA 23529

No. Students whose qualified tuition was entirely covered by formal billing arrangement, scholarship or grant for the entire calendar year did not receive a 1098T statement.

A student could receive a 1098T even if they did not register during a specific calendar year if:

- An adjustment was made to their financial aid for the previous year. It could be a reduction or an increase.

- An adjustment was made to tuition charges from the previous year. For example: an approved tuition appeal, administrative drop, change in domicile

Unfortunately, ODU is not qualified to give you tax advice. Please consult a tax advisor.

Since 2004, the IRS has required us to report any adjustments to reportable transactions from a prior year.

No. While we want to be helpful to students and their families, ODU staff is not qualified to assist you. The regulations are complex and we do not want to inadvertently misinform.

IRS regulations require that we report tuition and charges billed for each calendar year. The University apparently does not have your Social Security Number on file. Please send a photocopy of your Social Security card to the Registrar's Office. You may mail or fax the information. The Registrar's Office will not change your record based on a phone call or email. The Registrar's Office is responsible for inputting this information in the system. Once this has been completed, please contact your Accounts Receivable representative directly to have a corrected 1098T processed. The corrected copy may take up to two weeks since this function is outsourced.